We’re a fast-growing firm where exciting things are happening every day. You can keep up with the latest by:

Incentives Unleashed: Maximize ROI on Business Expansions

Billions of dollars are invested into U.S. businesses every year by economic development agencies across the country. These investments come in the form of tax credits and incentives aimed at attracting, recruiting, and supporting targeted industries. However, many companies are unaware of these incentives or mistakenly believe they don’t qualify. Even those who receive incentives often fail to maximize their benefits due to various reasons. In this blog, we will explore the importance of incentives, qualifying criteria, the best time to seek incentives, and the significance of performance metrics and proof of performance reporting.

[Read more…]Evergreen advises JRAD on its sale to Sayres Defense, a portfolio company of Broadtree Partners

Evergreen Advisors Capital, a middle-market investment bank, is pleased to announce that Sayres Defense, a Broadtree Partners portfolio company, has acquired Joint Research and Development (JRAD). Broadtree Partners is a middle-market private equity firm with a specific focus on aerospace, defense, intelligence, and federal civilian government services. JRAD is a leading provider of test and evaluation services, total life-cycle acquisition support, medical and public health preparedness, and science and technology research and development to government customers including DOD, DHS, and Federal Civilian Agencies. JRAD has extensive expertise in defense and homeland critical areas including weapons of mass destruction, emerging CBRN threats, modeling and simulation, systems engineering and integration and laboratory and non-laboratory sciences.

[Read more…]Evergreen Advisors Adds New Shareholders

Evergreen Advisors, a middle-market Investment Banking and Corporate Advisory firm with offices in Columbia, MD, and McLean, VA, is pleased to announce the admission of four new partners to the firm. Shelley Lombardo, Steve Prichett, Eric Clarke, and Patrick Lowry have been key members of the firm and have made significant contributions in accelerating the growth and success of our firm.

“This is an exciting time for Evergreen Advisors,” said Rick Kohr, CEO of Evergreen Advisors. “Over the past year, we have celebrated our move into new headquarters in the Merriweather area of Columbia and witnessed substantial growth across all practice areas of the firm. Equally significant, we are thrilled to welcome four highly-valued team members as owners, which is a remarkable achievement that recognizes their excellence in their respective areas of expertise and their unwavering dedication to our clients. We take immense pride in commemorating this exciting milestone with these well-deserved promotions. Evergreen feels fortunate to have such an exceptionally talented group of individuals to assume increased responsibilities as our firm continues to grow. We extend our heartfelt congratulations to them on this significant accomplishment.”

[Read more…]

Behind the Scenes with Fred Shaw: Vice President at Evergreen Advisors and Outsourced CFO at BTS

Fred Shaw is a Vice President in the CFO Advisory Practice of Evergreen Advisors, LLC. With diversified experience in both public and private accounting, Fred has provided financial advisory services to clients in various industries, including Manufacturing, Health Care, Service, and Government Contracting. At Evergreen Advisors, Fred helps businesses achieve their financial goals by providing tailored financial solutions that can help them grow, optimize operations, and improve financial performance. Whether clients need to improve cash flow, raise capital, or navigate complex regulatory requirements, Fred has the knowledge and expertise to guide them through the process.

[Read more…]Evergreen’s Jeff Reed to Attend Business Facilities LiveXchange

Jeff Reed, Senior Vice President of Evergreen Location Strategies will attend the 19th annual Business Facilities LiveXchange event in Myrtle Beach April 24th -26th where he will join professionals from across the country. With over 30 years’ experience in location analysis, site selection, and business incentive services, Jeff brings a wealth of knowledge and strategic consulting to not only corporate entities in the U.S. and abroad, but also to economic development agencies and communities seeking to gain a competitive edge. He is an expert in creative solutions to ensure ELS clients increase project ROI by maximizing incentives such as tax abatements and cash grants for infrastructure, new jobs, machinery and equipment, employee training and much more.

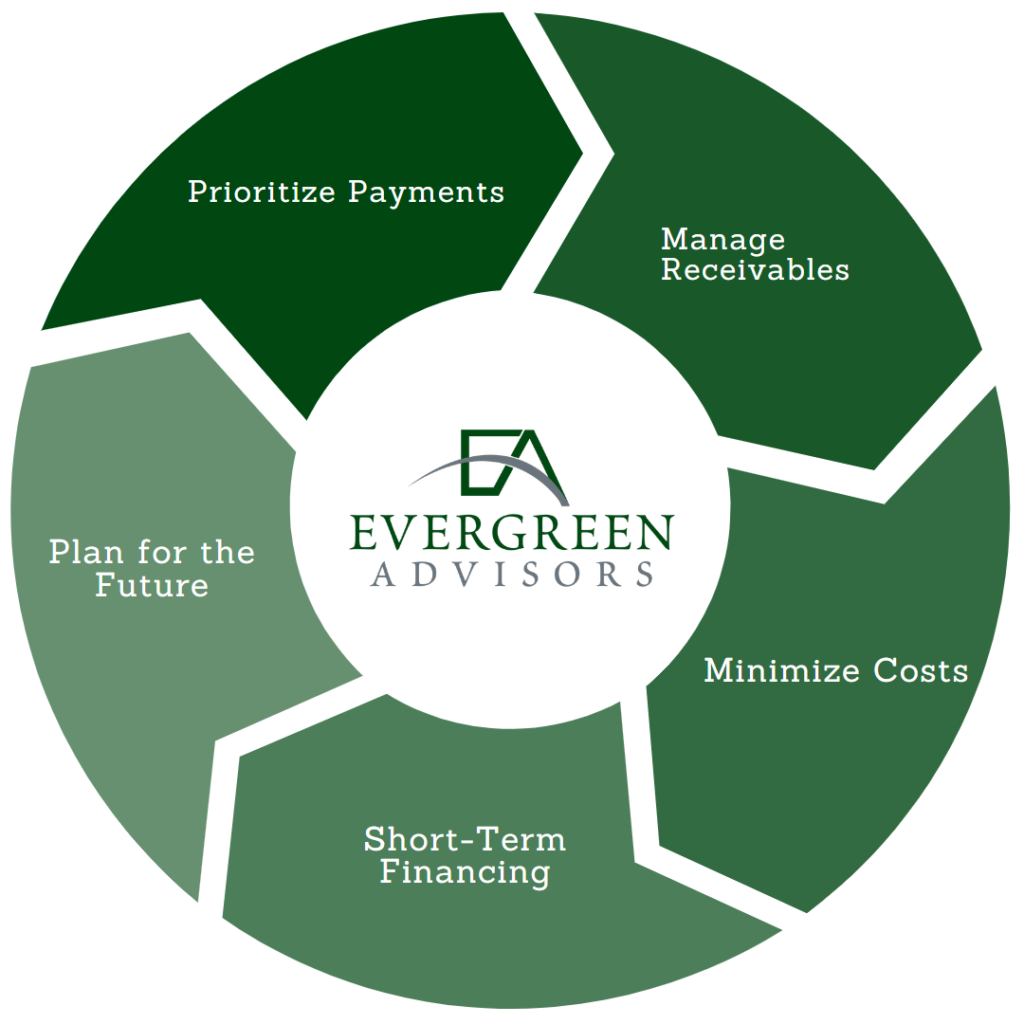

[Read more…]Cash Flow Management During a Recession

A recession is a period of economic slowdown that can have far-reaching consequences for businesses and individuals alike. With that in mind, it is more important than ever to be proactive and take control of one’s cash flow. It is a critical for both businesses and individuals to navigate the challenges posed by a recession.

Here are five ways to manage cash flow during a recession.

Evaluate all your outgoing expenses and prioritize them based on importance. Pay bills for essential services first, such as utilities, rent, and payroll. Evaluate if you are able to delay or renegotiate payments for non-essential expenses. Extending terms just five to ten days can have a huge compounding impact on your cash outlook.

[Read more…]Evergreen Advisors Welcomes Back Former Secretary of Commerce Mike Gill

Evergreen Advisors, a middle-market investment bank and corporate advisory firm with offices in both Columbia, MD, and McLean, VA, is delighted to announce that Mike Gill is returning to the firm as Chairman.

“We are thrilled to have Mike back on the team; the combination of being the first Secretary of Commerce of Maryland and his incredible business acumen makes him a tremendous asset to our clients and those companies looking to grow and expand their businesses. We couldn’t be happier to have him back!” noted Shelley Lombardo, Chief Operating Officer of Evergreen Advisors.

Mike is a business leader with four decades of experience as an entrepreneur, technology executive, investment banker, and public servant. Former Governor Larry Hogan selected him in 2014 and 2021 to head the Maryland Department of Commerce as its first-ever Secretary. While under Mike’s leadership, Commerce created an aggressive customer outreach effort, expanded its business development team, and increased its emphasis on Maryland’s growth industries, including life sciences, cybersecurity, advanced manufacturing, and higher education.

[Read more…]Evergreen Advises n2grate on its sale to BlueAlly

Evergreen Advisors Capital, a middle-market investment bank, is pleased to announce that BlueAlly, a Source Capital portfolio company, has acquired n2grate. Evergreen Advisors Capital acted as the exclusive financial advisor to n2grate. The terms of the transaction were not disclosed.

Rick Kohr, Chief Executive Officer of Evergreen Advisors Capital, noted, “Steve Halligan and the whole n2grate team have done an incredible job scaling the company to the outstanding IT consulting firm it is today. It was a pleasure to work with their team, and we are very excited about what BlueAlly and n2grate can do together”.

n2grate boasts a 13-year history of successfully supporting their government clients and large corporations with a range of information technology (IT) solutions. The company is a leading government IT solutions that has expertise focusing in networking, security, and infrastructure.

[Read more…]Vicki Horton Featured in January’s Site Selection Magazine

Vicki Horton, CEO of Evergreen’s Location Strategies practice, was featured in January’s issue of Site Selection Magazine to provide insight on key factors influencing the shifting sunbelt workforce. The article “Where, O Where Have the Laborers Gone” summarizes a recent survey completed by Site Selection Magazine covering why skilled workers are migrating to warm weather regions and the resulting impact on companies needing to increase labor pool access.

[Read more…]“There is a trend over the last five years that is generationally based,” says Vicki Horton. “Millennials have decided to move to second-tier cities like Charlotte, Nashville, Richmond, and Chattanooga. The labor force being there draws companies to those markets.”

Transaction Risk and Fairness Opinions

For almost 40 years, Fairness Opinions have been used as a critical part of the mergers and acquisitions process. A fairness opinion is a financial advisor’s opinion that states whether or not the financial terms of a proposed transaction are within a range of fairness, expressed from an economic point of view to one or more specific parties of the proposed transaction as of a particular date. By hiring a third-party financial advisor to issue a fairness opinion, company boards and trustees are able to mitigate risk and help fulfill their fiduciary responsibilities to their shareholders. Fairness Opinions have become a regular feature of corporate transactions since 1985 when the Delaware Supreme Court issued its opinion in the landmark case Smith v. Van Gorkum.

In Smith v. Van Gorkum, the Court found that a corporate board (Trans Union Corporation) breached its fiduciary duty of care by approving a merger without:

- understanding adequate information on the transaction

- including details on the value of the company

- reviewing the the fairness of the offering price

Rick Kohr Featured Capital M

Evergreen’s Chief Executive Office Rick Kohr was featured on Maryland Tech Council’s Capital M podcast, where he discussed what investors look for when considering investing in new companies and what is most important for companies when raising capital. The MTC’s Capital M podcast addresses the capital markets in DMV and elevates the conversation to help companies prepare for the market.

Don’t miss this podcast for an expert’s insight to hear what Rick Kohr has to say!

Evergreen Advisors Welcomes Jeffery Kinderman

Evergreen Advisors, a middle-market investment Bank, and Corporate Advisory firm, with offices in both Columbia, MD, and McLean, VA, is pleased to announce the addition of Jeff Kinderman to our Investment Banking practice.

“We are proud to add Jeff as an integral member of our investment banking team. Jeff‘s significant experience in deal execution and thought leadership in professional valuation services will add to the already robust capabilities of our investment banking practice. We are thrilled for him to be joining our team, and he is already adding value.”

[Read more…]

Evergreen Advises Communications Electronics on its sale to Mobile Communications America

Evergreen Advisors Capital, a middle-market investment bank, is pleased to announce that Mobile Communications America has acquired Communications Electronics. Communications Electronics is a leading provider of communication technology to public safety agencies, schools, hospitals, and enterprises across the Mid-Atlantic. Evergreen Advisors Capital acted as the exclusive financial advisor to Communications Electronics. The financial terms of the transaction were not disclosed.

“We are excited to have advised Communications Electronics throughout their acquisition,” said Rick Kohr, CEO of Evergreen Advisors Capital. “Communications Electronics is a leading provider of technology and expertise in the public and private sector markets; their track record of being a unified solution for customers made them an attractive acquisition target, and I look forward to seeing what these two companies can do together.

Communications Electronics boasts a 46-year history of successfully making mission-critical connections across the Mid-Atlantic. The company provides core communications technology by focusing on system design & engineering, sales, installation maintenance, technical support, and service agreements to ensure optimal systems and critical infrastructure performance.

[Read more…]Entrepreneur Spotlight: COMSO

Giving Back and Exceptional Performance are two ways COMSO is making it happen every day within the IC and IT industry in Maryland. Check out more about how they do it in our Entrepreneur Spotlight with Jacqui Magnes, CEO of COMSO.

- How did you come up with the vision, “Together we will Make it Happen”?

When I acquired COMSO, my vision was more of a textbook vision- Exceptional performance in all that we do. After rebranding and refreshing COMSO, digging deep to understand the resiliency and capabilities of COMSO, and do not forget to add, operating through a pandemic, we were Making it Happen every day, and we were doing it together. Change was starting to be fearlessly embraced, and confidence in our ability to prevail and grow, regardless of the circumstance, was being established. Exceptional performance is now one of our values.

[Read more…]Evergreen’s Shelley Lombardo Re-elected to Vice Chair of the Cybersecurity Association of Maryland

The Cybersecurity Association of Maryland, Inc. (CAMI), Maryland’s only nonprofit organization dedicated to improving the local cybersecurity ecosystem, today announced new appointments to its Board of Directors, including its Executive Committee.

CAMI’s Board of Directors, composed of 24 prominent technology and cybersecurity leaders, remains at the forefront of driving the organization’s programming to best accommodate CAMI’s nearly 650 members and the broader regional cybersecurity community. The Executive Committee consists of:

[Read more…]Evergreen Advises Wheelhouse on its Sale to Cadmus

Evergreen Advisors Capital, a middle-market investment bank, is pleased to announce that Wheelhouse Group has been acquired by Cadmus. Cadmus, a technical consultancy company headquartered in Waltham, MA, and Wheelhouse Group headquartered in Fairfax, VA, have established themselves as successful firms focused on advancing the mission of their clients.

Evergreen Advisors Capital acted as the exclusive financial advisor to Wheelhouse Group with Legal and accounting support provided by Zarren Law Group and KWC. The Evergreen Advisors Capital deal team included Steve Prichett and Justin Horsman. The financial terms of the transaction were not disclosed.

[Read more…]“Wheelhouse has built a fantastic business prepared to capitalize on the evolving market by providing leading solutions to their clients. Cadmus embodies a terrific strategic and cultural fit – we are thrilled for their continued success,” stated Steve Prichett, Managing Director, Evergreen Advisors Capital.

Evergreen’s Jeff Reed Joins Transatlantic Business & Investment Council Advisory Council

Evergreen Advisors is pleased to announce that Jeff Reed, Director in the Locations Strategies Practice, has been appointed to the Advisory Council of The Transatlantic Business and Investment Council (TBIC). TBIC’s focus is to promote transatlantic trade and investment; creating millions of jobs in communities all over the United States.

[Read more…]“I am honored that the members of TBIC have invited me to join their Advisory Council. With decades of experience working with companies from around the globe, I understand the value that an organization such as TBIC provides to their members. I am grateful for this opportunity, and I look forward to highlighting all the services offered by Evergreen Advisors to international clients. specifically, the services of Evergreen Location Strategies.”

A Strategic CFO: Why a Strategic CFO is a Priority

A strategic CFO will be your course navigator, someone you can trust to be your co-pilot, an expert you can depend on to help make important decisions for your company. Whether your business is an early stage or an established enterprise, a strategic CFO is imperative to a successful company at any stage in its life cycle in order to strengthen a company’s financial foundation, improve performance, and accelerate growth. Companies who forgo a CFO until they “believe the company is large enough” will face roadblocks and red tape that can hinder growth and create obstacles that all companies want to avoid.

[Read more…]Evergreen’s George Davis & Baltimore say Goodbye to Trey Mancini after he gets traded to the Houston Astro’s

George Davis, to Evergreen, is a Strategic Advisor who is well-known for his success in investing, building, and managing biotech, IT, and software companies, often from the start-up stage. He is an active leader in the tech and innovation community, serving on a number of boards, including Betamore, UMBC’s Research Park Corporation, Association for Enterprise Growth, and the Fearless-backed Hutch Studio. What is little known about George is his work as a Johns Hopkins Cancer Survivor Patient Advocate.

In 2020 & 2021, George served as a Patient Mentor to the Orioles’ first baseman and designated hitter Trey Mancini, who was diagnosed with Stage 3 Colon Cancer in March of 2020. Trey had gotten a routine physical for the blood draw showed that his hemoglobin and hematocrit were low. It was then that a colonoscopy was scheduled, and the tumor was found. After a year of treatment, he is now cancer-free. Trey is fortunate as colorectal cancer is the third deadliest cancer in the United States — after lung and prostate in men and lung and breast in women. What is not often realized is that half of all new colorectal cancer diagnoses are in people 66 or younger. The most challenging part is that those diagnosed with colorectal cancer often have experienced no signs or symptoms associated with the disease.

[Read more…]Evergreen Advisors Relocates Headquarters to Downtown Columbia

Evergreen Advisors, a middle-market Investment Bank and Corporate Advisory Firm, is thrilled to announce that they have officially moved into their new Headquarters in downtown Columbia, Maryland.

“We have seen significant growth in our business in recent years. This has created an opportunity to relocate and expand our headquarters in the heart of the Baltimore and Washington corridor. I think it’s just a great place to be. It has become one of the best places in the country to build and operate a business; it’s comprised of a diverse and talented group of people in the region,” said Rick Kohr, founder and CEO of Evergreen Advisors

The company is extremely excited about the new space and all the additional amenities the area has to offer. Evergreen Advisors occupies 10,932 square feet of the entire top floor of 30 Columbia Corporate Center, off Little Patuxent Parkway in Columbia, MD. The 12-story building is one of seven office buildings in Corporate Row.

[Read more…]Evergreen Advisors Welcomes John Goode

Evergreen Advisors, a middle-market Investment Bank, and Corporate Advisory Firm, with offices in both Columbia, MD and McLean, VA, is pleased to announce the addition of John Goode to our CFO Advisory Practice.

“We are excited to add John to our CFO Advisory team. John is a seasoned forward-thinking CFO whose experience in strategy, process improvement, and exceptional analytical skills will be an invaluable benefit to our clients”

-Eric Clarke, Managing Director of Evergreen’s CFO Advisory Practice

John Goode has fostered his executive financial management experience through strategic roles as a COE/CFO for a large regional construction company and several professional IT-based companies in the Mid-Atlantic region. John has prominent experience in the following industries: construction, oil and gas production, information technology, CFO consulting, public accounting, radio broadcasting, and government contracting. John earned dual Bachelor of Arts degrees in Accounting and Business Administration from Loyola College (now Loyola University) in Baltimore, Maryland, and is a Certified Public Account in the State of Maryland.

[Read more…]Evergreen Advises Clareto on its Sale to Munich Re

Health Catalyst Capital Management LLC (“HCC”), a New York-based private equity firm investing in growth stage healthcare information technology and technology-enabled services businesses, is pleased to announce the sale of its portfolio company MedVirginia, Inc., doing business as Clareto (“Clareto”), to Munich Life Holding Corporation (“Munich Re”).

Clareto partners with health information exchanges (HIEs) and other electronic health record (EHR) data sources to facilitate the collection of electronic health information pursuant to HIPAA-compliant authorizations in support of underwriting, claims, and other business processes for the life insurance industry. Clareto has partnerships with more than 25 health information exchanges (HIEs) and electronic health record (EHR) software vendors.

“Congratulations to our client, Clareto, on its successful sale to Munich Life Holding Company. The Evergreen Advisors team is thrilled to have helped Clareto find a partner to continue Clareto’s rapid growth in the rapidly evolving insuretech arena.” Steve Prichett, Managing Director, Evergreen Advisors Capital

Clareto joined HCC’s portfolio in February 2019. HCC’s investment in Clareto is a result of deep thematic research into interoperability and insuretech. Dave Dorans, CEO of Clareto, commented that “HCC has been a stalwart supporter of Clareto these last three years, including leading our latest financing round leading to this sale.”

[Read more…]Evergreen Advisors Announces New Promotions

Evergreen Advisors, a middle market Investment Bank and Corporate Advisory Firm with offices in Columbia, MD, and McLean, VA, announced the promotion of two professionals today. Morgan Trask and Jacob DiMattia were promoted to Senior Consultant in the Location Strategies Practice.

Morgan Trask joined Evergreen in November of 2019 and Jacob DiMattia in March of 2021. They focus on assisting corporate clients with optimizing their location decisions as well as their ability to realize valuable economic incentives such as cash grants, tax abatements, PILOT agreements, sales tax sharing agreements, employee training grants, payroll rebates, sales and use tax refunds, utility benefits, and other economic incentives.

[Read more…]Evergreen Announces New Headquarters

Columbia, MD – Evergreen Advisors, a middle market Investment Bank and Corporate Advisory Firm with offices in Columbia, MD and McLean, VA, is pleased to announce they have signed a lease to relocate their headquarters to Downtown Columbia, Maryland, in the Summer of 2022.

“We have seen significant growth in our business in recent years. This has created an opportunity to relocate and expand our headquarters in the heart of the Baltimore and Washington corridor. We explored a number of options in the region – this particular location provided us a great environment for our team with gorgeous views of Symphony Woods, walkability to restaurants, and other amenities of Columbia,” said Rick Kohr, Founder and Chief Executive Officer of Evergreen Advisors.

“We have seen significant growth in our business in recent years. This has created an opportunity to relocate and expand our headquarters in the heart of the Baltimore and Washington corridor. We explored a number of options in the region – this particular location provided us a great environment for our team with gorgeous views of Symphony Woods, walkability to restaurants, and other amenities of Columbia,” said Rick Kohr, Founder and Chief Executive Officer of Evergreen Advisors.

[Read more…]Evergreen Advises ESS on its sale to Godspeed Capital

Godspeed Capital Management LP (“Godspeed Capital”), a lower middle-market Defense & Government services, solutions, and technology focused private equity firm, today announced the successful acquisition of Exceptional Software Strategies, Inc. (“ESS” or the “Company”), a leading provider of information technology solutions to mission-oriented Federal agencies, including members of the Intelligence Community and Department of Defense agencies. The financial terms of the transaction were not disclosed.

ESS boasts a 25-year history of successfully integrating mission-critical information technology solutions across the Intelligence Community. The Company provides core capabilities in cyber, software and systems engineering, and geographic information systems, and works with a broad array of Intelligence Community and Federal agencies with critical National Security missions, including a strong presence in Fort Meade, Maryland.

Nearly each of the Company’s seasoned engineers across its dynamic team holds the highest-level of security clearance. By developing, testing, and deploying solutions to mitigate and combat threats across emerging areas of critical importance such as blockchain, cloud computing and storage, data analytics, and artificial intelligence, ESS is critically focused on leading the next frontier of cyber-protection and innovation.

[Read more…]Evergreen Advisors Annonces Promotions

Evergreen Advisors, a boutique middle market Investment Bank and Corporate Advisory Firm with offices in Columbia, MD, and McLean, VA, announced the promotion of two professionals today. Justin Horsman was promoted to Director in the Investment Banking practice, and Eric Clarke was promoted to Managing Director of the CFO Advisory Practice.

[Read more…]Justin Horsman Promoted to Director

We are excited to announce the promotion of Justin Horsman to Director in the Investment Banking practice.

Justin Horsman joined Evergreen Advisors in 2013 as a member of the Corporate Advisory Practice providing business valuation and financial advisory services. More recently, Justin has focused predominantly on providing investment banking services to middle-market companies.

He has significant experience advising clients on a variety of engagements, including, but not limited to, mergers and acquisitions, recapitalizations, and strategic growth initiatives. Before joining Evergreen Advisors, Justin was a Senior Associate at T. Rowe Price and worked in their Fixed Income and Equity Pricing Divisions. Justin is a Registered Securities and Investment Banking Representative (Series 6, 7, 79, and 63) and holds the Chartered Financial Analyst (CFA) designation.”

[Read more…]Eric Clarke Promoted to Managing Director

Evergreen Advisors is proud to announce the promotion of Eric Clarke to Managing Director of the CFO Advisory Practice.

Eric Clarke joined Evergreen in April of 2015 and will be responsible for leading and expanding the CFO Advisory Practice. Eric’s practice has focused on early to mid-stage venture-back staged companies and he has been an integral part in their success as they capitalized their companies and through to their acquisition. Eric will bring Evergreen’s CFO Advisory Practice serves growing businesses that need quality financial management, strategic guidance, and infrastructure development, assisting companies through the various stages of the company lifecycle, ranging from strategic shareholder initiatives to critical operational needs.

Evergreen Advises TMAC on its sale to ManTech

January 03, 2022 08:00 ET | Source: ManTech International Corporation

HERNDON, Va., Jan. 03, 2022 (GLOBE NEWSWIRE) — ManTech International Corporation (Nasdaq: MANT) has completed the acquisition of Technical and Management Assistance Corporation (TMAC), a leading provider of advanced data engineering services and solutions to the U.S. Intelligence Community.

Headquartered in Columbia, Maryland and founded in 2008, TMAC offers a full range of data centric solutions and expertise with proven experience in systems engineering, data collection and governance, analytics and mission management systems.

Evergreen Advises [INVNT GROUP]

[INVNT GROUP]™ Bets Big on Live; Enhances Live Brand Storytelling Capabilities with Newly Formed ITP LIVE, in the Strategic Acquisitions of InSync Production Services, Thunder Audio and Morpheus Lights.

Introducing ITP LIVE: An Integrated Production Services Division of INVNT®

New York, NY — [INVNT GROUP] THE GLOBAL BRANDSTORY PROJECT™ announces the strategic acquisitions of four historied live event production companies: ITP LIVE, InSync Production Services, Thunder Audio, and Morpheus Lights.

Led by President and CEO, Scott Cullather, [INVNT GROUP] represents a growing portfolio of complementary disciplines designed to help forward thinking brands everywhere, impact the audiences that matter anywhere.

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 9

- Next Page »