Whether it’s a contentious litigation, a shareholder buyout or IRS audit, having a credible business valuation expert is critical. Credibility comes from the combination of preparation, expertise, integrity and consistency. For more than 20 years, Evergreen has helped clients navigate difficult valuation and transaction matters. Our staff of credentialed valuation professionals have a proven track record of developing and supporting well-reasoned opinions that withstand scrutiny.

Each valuation engagement presents a unique set of demands, which can be difficult to navigate. An in-depth knowledge of valuation standards, tax, case law, and GAAP (“Generally Accepted Accounting Principles”) is required to ensure appropriate methods and approaches are applied. Evergreen’s credentialed Business Valuation experts appreciate and understand these requirements and have extensive industry experience.

- Estate & Gift Tax Planning

The Fair Market Value opinions of Evergreen Advisors are regularly sought by the leading legal and accounting firms in our market for a variety of purposes, including federal estate and gift tax planning matters. Whether the need is for a valuation of privately-held assets held in an estate, or the valuation of privately-held stock made as a gift to family members or charitable contributions, Evergreen’s extensive experience in estate and trust tax matters provides our clients with credible and defendable valuations required for the Internal Revenue Code compliance. For our corporate clients, we also offer our valuation services for income tax purposes, which include S conversions, corporate spin-offs, and taxable distributions. - Fair Value for Financial Reporting

The business valuation opinions of Evergreen’s Business Valuation Group are sought by accounting firms and their clients for financial reporting purposes. Our specialists are familiar with Fair Value standards required for GAAP and provide valuation opinions for intangible assets included in acquisition transactions. Our valuations are typically required to support purchase price allocations, testing for goodwill impairment, and equity-based compensation. - Equity Incentive Plans (409A)

Increasing productivity and profitability through equity-based compensation arrangements is a strategy often sought by owners of both emerging and established businesses. The issuance of stock options, stock appreciation rights, or other forms of equity-based compensation, including ESOPs can involve complex accounting, business, valuation, and taxation issues. Evergreen Advisors assists our clients in tailoring plan provisions for your business, identifying the cost and impact of various alternatives, and evaluating appropriate value drivers. Finally, we can provide our clients with business valuation opinions of equity for tax and financial reporting purposes.

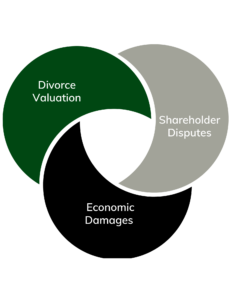

- Litigation Support

1. Divorce Valuation

1. Divorce Valuation

In a marital dissolution, the value of a couple’s assets and liabilities are determined, including any interests in closely-held businesses. Evergreen has experience with the treatment of personal goodwill and the different valuation standards across Maryland, Virginia, and Washington, D.C.

2. Shareholder Disputes

Evergreen offers a team of experts to facilitate resolution in contentious matters amongst shareholders. Our services include assistance with settlement negotiations, analysis of opposing valuation expert opinions, educating clients on the drivers of valuation, and offering expert witness testimony when required.

3. Economic Damages

Evergreen routinely performs analyses related to disputes over lost business value, lost profits, and breach of contract claims. Our analyses and damages opinions are supported with expert testimony in depositions, courts, arbitrations, and mediations.

The Evergreen Advisors Fairness Opinion Committee has provided Boards of both public and private companies with independent, expert advice as part of the Board’s fiduciary obligations to shareholders. We provide opinions as to whether the consideration received in a transaction is fair from a financial point of view, using rigorous financial analysis and due diligence.

Our Fairness Opinion Committee is composed of senior leadership, ensuring that every opinion we conduct is accurate, logically supported, and follows best practices and regulatory guidance.

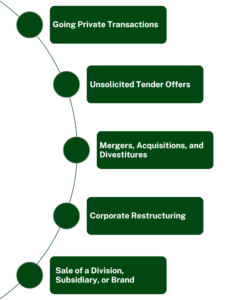

- Transaction Support

The most important issue buyers and sellers of privately-held companies are confronted with is that of value. Evergreen Advisors often provides Business Valuation Advisory Services with respect to validating or establishing a buy/sell price in connection with a transaction. As the sale process frequently occurs over several months, we also provide our clients with ongoing assessments of value based upon the target’s performance, industry trends and economic events. As part of our analysis, we routinely supplement our valuation opinions with information on actual transaction structures in the client’s industry - Employee Stock Ownership Plan

We understand that a well-documented, independent, unbiased valuation of an ESOP company’s stock is a critical part of the process. ESOP transactions are regulated by the Department of Labor (DOL), and they typically have significant tax implications. Therefore, an ESOP valuation must be able to withstand potential challenges from multiple parties, including the DOL, the IRS, and the company’s employees.

Evergreen Advisors has completed 650+ business valuations for litigation and non-litigation matters for companies across various industries with sizes ranging from early-stage to multi-million dollar publicly traded companies serving the Mid-Atlantic region, including Maryland, Washington D.C., Virginia, and Pennsylvania. Evergreen Advisors, LLC was formed in 2001 to provide innovative and strategic solutions to meet our client’s evolving business needs. Contact us at info@evergreenadvisorsllc.com for more information on our Valuation Services.