A recession is a period of economic slowdown that can have far-reaching consequences for businesses and individuals alike. With that in mind, it is more important than ever to be proactive and take control of one’s cash flow. It is a critical for both businesses and individuals to navigate the challenges posed by a recession.

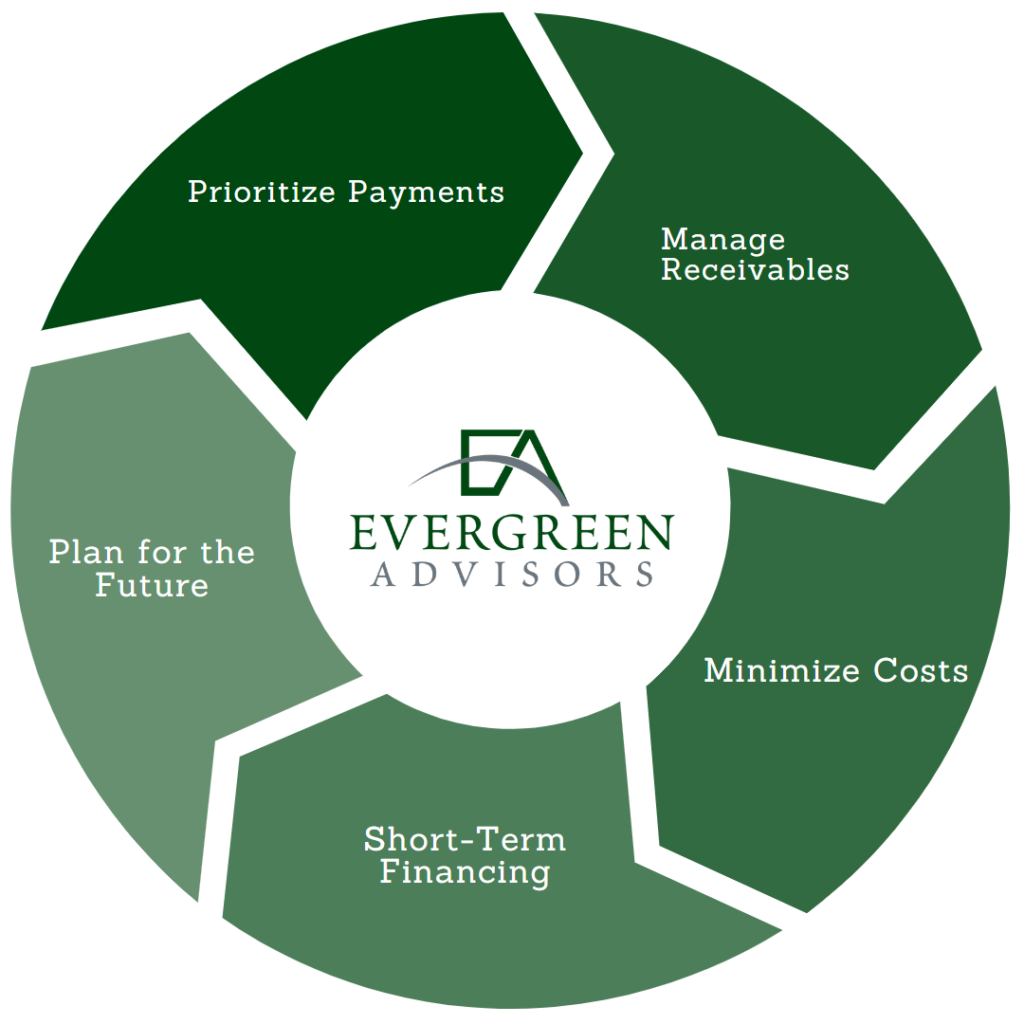

Here are five ways to manage cash flow during a recession.

Evaluate all your outgoing expenses and prioritize them based on importance. Pay bills for essential services first, such as utilities, rent, and payroll. Evaluate if you are able to delay or renegotiate payments for non-essential expenses. Extending terms just five to ten days can have a huge compounding impact on your cash outlook.

While it is critical to manage how fast your invoices go out, it is also important to have a collections process in place. This means proactively managing your past-due accounts and setting up a process to inquire on the status and send reminders.

Additionally, evaluate the norm for payment terms for your business and determine if they can be shortened. It may even be possible to reward customers with a pre-payment discount if this is applicable to your industry. Losing time in sending an invoice and managing aging reports asking for pre-payment are all levers you can control.

Cut down on unnecessary expenses, such as office expenses, travel expenses, and entertainment expenses. You can also reduce costs by negotiating better deals with your suppliers, reducing your workforce through attrition or layoffs, or consolidating locations.

If your cash flow is tight, consider using short-term financing options, such as lines of credit, invoice financing, or merchant cash advances. However, be cautious of high-interest rates and fees associated with these options. Creating pro forma cash flow scenarios to assess how to financing will be utilized compared to the cost of capital is essential (i.e. does the financing achieve a new company milestone worth the financing costs?).

While you are developing contingency plans to increase working capital, be aware of the impact your customers and vendors may have on your business. Just as you are negotiating better terms from your vendors, your customers may ask the same of you. Prepare for those scenarios and have a plan already in place.

Cash flow management is critical during a recession, and by following these five tips, you can ensure the survival and success of your business. Prioritize payments, increase revenue, minimize costs, utilize short-term financing, and plan for the future to ensure that your business is prepared for any economic slowdown.

How Evergreen Can Help:

Evergreen Advisors’ CFO Practice manages the accounting needs of emerging and high-growth companies along the various stages of their growth continuum. With our numerous experienced CFOs, we specialize in all life cycles of a company, from an emerging growth company building its infrastructure or a later-stage company that needs special assistance. Evergreen’s Advisors CFOs will work as senior members of your management team to provide strategic guidance and oversee day-to-day operations.

Evergreen’s CFO Advisory practice aids in business and financial strategy, budgeting, forecasting, reporting, financial planning and analysis, and supporting capital raisins. Evergreen’s experienced experts are proactive in strategic leadership and will help scale your business through a dynamic decision-support strategy.

If you are in need of an experienced CFO, please visit our website at www.evergreenadvisorsllc.com.

About Evergreen Advisors:

Evergreen Advisors is a middle-market investment bank and corporate advisory firm focused on servicing organizations throughout their financial lifecycles to drive successful outcomes. Serving the Mid-Atlantic region including Maryland, Washington D.C., Virginia, and Pennsylvania, Evergreen Advisors, LLC was formed in 2001 to provide innovative and strategic solutions to meet our client’s evolving business needs.