Authored By: Will O’Donnell

Valuing early-stage companies involves not only understanding their growth trajectory but also examining the broader forces shaping their markets. While traditional company stages and valuation methods provide a foundational framework, evolving market trends are redefining how these methods apply in today’s venture environment. Key trends are emerging that significantly impact early-stage companies and their valuations. Here are some of the most notable developments:

1. Rise of Secondary Market Transactions

The landscape of private equity is shifting as secondary sales of private company equity become a vital liquidity tool for general partners. In response to the sluggish exit environment, many companies are turning to secondary transactions to provide much-needed cash flow. New platforms, databases, and analytical tools have emerged, simplifying the process of sourcing, evaluating, and executing these transactions. For valuation professionals, these secondary sales serve as crucial indicators of value. They can be used to back-solve and determine the valuation of a company’s total equity or its various classes of equity.

2. Dominance of Artificial Intelligence (AI)

Artificial intelligence is making waves in the venture capital arena, outperforming other technology sectors. Data from Pitchbook reveals that 37.5% of unicorn deals in the past two years have been linked to AI. In Q1 2024, AI companies accounted for 34% of all deal value in the U.S. venture market. These companies are attracting higher valuations compared to other technology sectors such as software as a service (SaaS), e-commerce, and fintech. Many AI firms, particularly those focused on enterprise solutions or AI-driven software, operate on SaaS-like business models, making key metrics like the Rule of 40 increasingly relevant in their valuations.

3. Economic Conditions and Investor Caution

As high interest rates and persistent inflation shape the U.S. economy, investors are approaching the market with caution. Their preference for quality investments has enabled top-performing companies to stand out. However, startups in need of cash but wishing to avoid down rounds may resort to financing methods like simple agreements for future equity (SAFEs) and convertible notes. SAFEs allow companies to raise funds to manage cash burn while delaying an official fundraising round until market conditions improve. While these tools are effective for raising capital, they introduce complexity for valuation providers, complicating the selection of appropriate equity allocation methodologies.

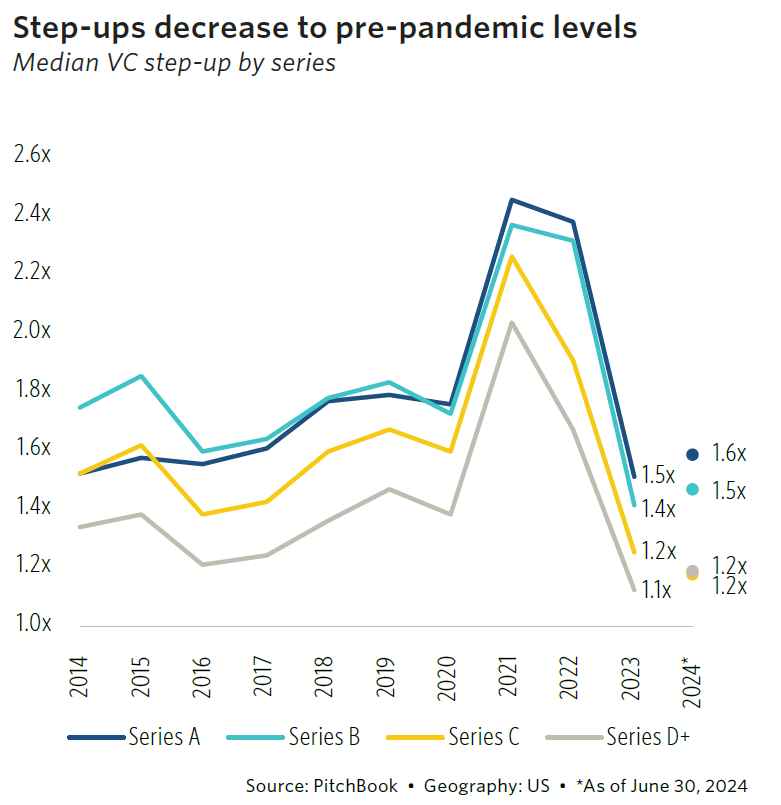

4. Decline in Step-Up Multiples

The current funding rounds for early-stage companies with venture capital investors are witnessing a notable decline in step-up multiples. This trend can be attributed to the inflated valuations seen two years ago during the pandemic. While step-up multiples are often used as proxies for value creation, investors recognize that the valuations during that period were not sustainable compared to normalized market conditions. Consequently, as valuations begin at a higher level, it becomes increasingly challenging to achieve further growth. The chart below, created by Pitchbook, illustrates recent trends in step-up multiples by funding round:

5. Expanded Role of Accelerators

In today’s challenging economic landscape, launching and sustaining a business is more daunting than ever, particularly for new entrepreneurs. The past decade has introduced unprecedented hurdles, making the startup journey increasingly complex. With pre-seed and seed activity slowing, early-stage companies must provide investors with more substantial information and observable metrics to better showcase their risk profiles. In response to these challenges, accelerators and inception-stage investors are emerging as critical support systems in the startup ecosystem. Their role extends beyond mere financial backing; they offer a holistic approach to startup development, nurturing startups during their most vulnerable phase.

Essential Insights for Effective Valuation of Early-Stage Companies

Understanding current trends is essential for accurate valuations in today’s rapidly changing market. By staying attuned to these dynamics, valuation professionals can effectively navigate the complexities unique to early-stage companies.

Evergreen Advisors combines deep industry insight with proven valuation methodologies, equipping clients to make confident, informed decisions in a shifting landscape. Connect with our team today to learn how we can support your valuation needs and help you leverage these insights for your company’s growth.

Ready to Enhance Your Valuation Strategy?

The evolving landscape of early-stage valuations requires precision, insight, and an adaptable approach. Our team at Evergreen Advisors is here to help you leverage these market insights for strategic growth.