Authored By: Will O’Donnell

Valuing early-stage companies presents unique challenges compared to established businesses. The complexity arises from multiple factors, including the company’s stage of development, the appropriate valuation methods for these entities, and the types of equity typically issued. In this article, we’ll break down these topics, including the latest guidance from the American Institute of Certified Public Accountants (AICPA).

Identifying the Stage of Enterprise Development

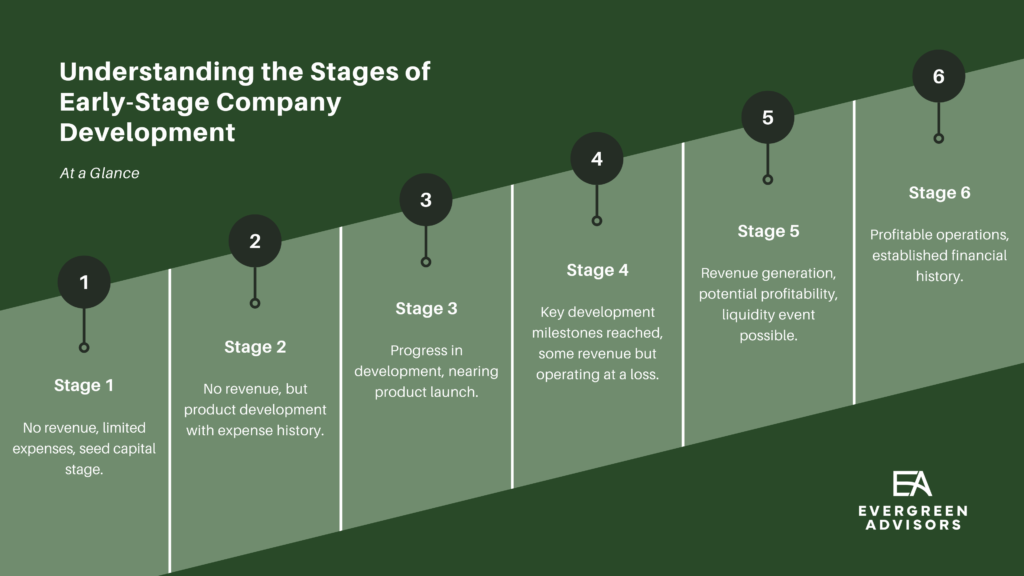

A company’s stage of development plays a critical role in determining which valuation methods are most appropriate. Correctly identifying the company’s development stage is one of the first steps in the valuation process. The AICPA provides a comprehensive framework in its Valuation of Portfolio Company Investments of Venture Capital and Private Equity Funds and Other Investment Companies guide (the “AICPA Guide”). This guide outlines six stages of development:

Stage 1

The company is in its ideation phase, with no revenue, limited expense history, and an incomplete management team. Initial funding is typically provided by friends, family, angels, or venture capital firms.

Stage 2

Although revenue is still absent, product development is underway, with a more substantive expense history. The company is likely in its second or third round of financing.

Stage 3

Significant product development progress has been made, key milestones are being hit (such as assembling a management team), and development may be near completion. However, the company still has no revenue.

Stage 4

The company has achieved major development milestones and some product revenue, but it’s still operating at a loss. Mezzanine financing typically happens here.

Stage 5

The company has started generating revenue and may have achieved profitability or positive cash flow. A liquidity event, such as an IPO or acquisition, could occur in this stage.

Stage 6

With an established financial history of profitable operations, the company might stay private for an extended period, although public options remain.

To effectively illustrate the stages of early-stage company development and their impact on valuation, let’s take a closer look at a visual representation that outlines each stage and its characteristics:

When valuing an early-stage company, it is imperative to correctly identify its stage of development to align its progress with the appropriate valuation methodology.

Valuation Methods by Stage of Development

The AICPA Guide provides insights into which valuation methods are typically used at each stage of development:

Stage 1

Since there’s no revenue and limited financial history, a discounted cash flow (DCF) method is generally not recommended. Calibrating to a recent financing round can be more reliable. In the absence of financing rounds, other considerations include evaluating the company’s performance, burn rate, and significant internal or external factors that could influence value. The asset accumulation method may be applicable, though intangible assets and goodwill complicate this.

Stage 2

Like Stage 1, calibration to recent transactions remains a reliable method. While the DCF method becomes slightly more relevant, forecasting remains difficult. Market-based approaches typically aren’t reliable at this stage.

Stage 3

Financial forecasts start to become more reliable, making the DCF method more viable, though high discount rates are often necessary. The market approach may still not be a good fit, but calibration to institutional financing rounds can provide a solid indication of value.

Stage 4

Both the income and market approaches can now be appropriate. As financial information improves, the market approach using calibration becomes more reliable. It’s also important to account for the company’s growth and profitability compared to industry peers.

Stage 5

The income and market approaches continue to be effective, though calibration may not be as reliable if new financing rounds involve strategic investors rather than financial ones.

Stage 6

At this point, both the income and market approaches are fully appropriate, with calibration used for arm’s-length transactions when applicable.

Selecting the right valuation method depends on the company’s development stage and available data. In many cases, companies may straddle different stages, requiring the valuation provider to use professional judgment.

Types of Equity Issued

Early-stage companies often have complex capital structures, including multiple classes of stock, convertible securities, and stock options. This complexity makes valuation more challenging than in companies with a single class of equity. For instance, preferred stock with liquidation preferences can significantly affect how proceeds are distributed in an exit event.

In recent years, simple agreements for future equity (SAFE) notes have become popular as a seed funding instrument. Unlike convertible notes, SAFEs aim to simplify the funding process but also introduce complexities in valuation due to their rights and preferences.

Common methods for allocating equity value across different classes include:

- Current Value Method (CVM)

- Probability Weighted Expected Return Method (PWERM)

- Option Pricing Method (OPM)

- Hybrid methods, which combine elements of the above approaches.

In cases where performance-based vesting or other complex features are present, more sophisticated analyses such as Monte Carlo simulations may be required.

The Valuation Advantage: Positioning Your Startup for Success

Valuing early-stage companies requires a deep understanding of their unique complexities—whether it’s determining stock option strike prices for Section 409A compliance, calculating deferred compensation under ASC 718, or assessing fair value for venture capital portfolios. Accurate and compliant valuations hinge on knowing the nuances of each development stage, the appropriate valuation methods, and how to navigate complex equity structures.

At Evergreen Advisors, our team has extensive expertise in handling these challenges. With a wide range of experience across regulatory and financial contexts, we provide reliable valuations for emerging businesses, ensuring that they are well-positioned for growth and success. If you’re interested in talking to our team, please contact us today.

Power Your Company’s Growth with Strategic Valuation Insights

Leverage tailored valuation methods to navigate early-stage complexities and position your business for long-term success.